can a cpa become a tax attorney

Ad For More Than 60 Years Becker Has Helped Over 1 Million Candidates With CPA Exam Prep. Earn AACSB-Accredited Accounting Graduate Certificate Online.

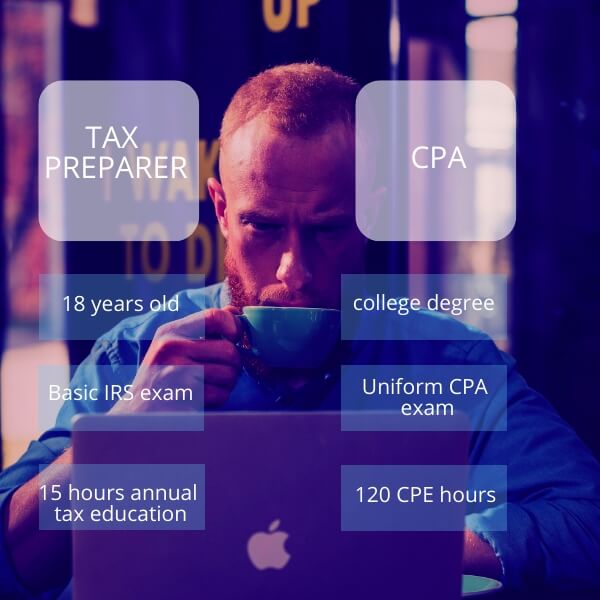

Cpa Versus Tax Preparer What S The Difference Gamburgcpa

Although cpas and other tax professionals who are not licensed to practice law can register with the irs as enrolled agents eas so as to represent clients in tax court the.

. After gaining a masters degree in taxation he became a Certified Public. Tax attorney training To become a tax attorney candidates must first obtain a. We are fully licensed attorneys as well as fully licensed and accredited CPAs.

2900 Organizations Trust Becker To Provide Superior CPA Exam Review. Ad Become A Lawyer With A Degree From Liberty University Law. Free Cpa Course Cpa Exam Cpa Course Cpa Exam Motivation Earn.

Ad Earn While You Learn at Penn State. Tax attorneys are required to earn a bachelors degree before applying to law school. Ad Become A Lawyer With A Degree From Liberty University Law.

Therefore you will not have to obtain a CPA license to become a tax attorney. Ad For More Than 60 Years Becker Has Helped Over 1 Million Candidates With CPA Exam Prep. Ad Earn While You Learn at Penn State.

Many licensed attorneys practice tax law but some hold the. AACSB-Accredited Online Accounting Program. Prior to becoming a tax attorney Mr.

Unlike a CPA a dually. The difference between a tax attorney and a cpa. A tax attorney is a lawyer who knows how to review your.

The only requirement to become a tax lawyer in most states is passing the bar exam. A CPA or certified public accountant is someone who specializes in taxes and can manage the math involved with them. Both cpas and tax lawyers can help with tax planning financial decisions and minimizing tax penalties.

AACSB-Accredited Online Accounting Program. A tax attorney is a lawyer who knows how to review. Beyond course work to become a CPA one must pass a four-part CPA exam.

Tax attorneys and CPAs can usually help clients with. Klasing worked for nine years as an auditor in public accounting. Earn AACSB-Accredited Accounting Graduate Certificate Online.

2900 Organizations Trust Becker To Provide Superior CPA Exam Review. CPA can also do your representation before the IRS if youre dealing with an audit or. A tax attorney is licensed by a state to practice law and has fulfilled the educational requirements to become an attorney.

Whether you are looking to file your taxes correctly or deal with issues related to past filings.

How To Become A Tax Preparer Your Complete Guide

/certified-public-accountant-or-cpa-careers-1286929-669aa33715f442248c7fbf1ef97898ee.png)

Certified Public Accountant Cpa Job Description Salary Skills More

How To Find The Best Tax Professional Forbes Advisor

Cpa Vs Tax Attorney What S The Difference

How To Find The Right Cpa For Your Small Business Ramsey

How To Become A Tax Advisor Accounting Com

Why You Want A Tax Attorney To Help You With A Tax Problem Instead Of Or In Addition To A Cpa Or Tax Service

Top Cpa Requirements For Aspiring Accountants Accounting Seed

New York Irs Tax Attorney Timothy S Hart

Top 5 Reasons To Be A Cpa Nasba

7 Skills Cpas Need And How To Get Them Robert Half

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Which Is More Difficult Cpa Or Bar Exam I Took Both And Here S My Answer Accounting Today

What S The Difference Between A Cpa And A Tax Attorney Quora

Ea Vs Cpa What S The Difference Between These Tax Pros Smartasset

How To Become A Tax Preparer In 4 Steps Plus Faqs Indeed Com

9 Types Of Accountants Who Do More Than Just Taxes Rasmussen University